Balloon loans are loans that do not fully amortize over its term. These balloon loans attract more borrowers because they are short-term yet have a low interest rate. However, it has a refinancing risk wherein the interest rate may double. If you want to be on top of your finances and be on your way to clearing out your debts, there are ways to keep track of your debts and create a budget to cover them. A great tool for this is the Free Balloon Payment Calculator Excel Template.

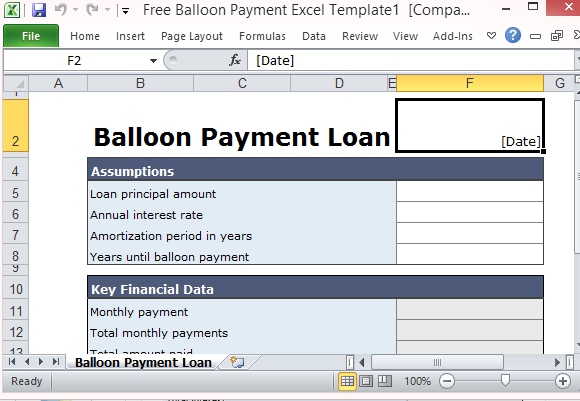

This Balloon Payment Calculator Template contains a tables that lets you type in information on your balloon loan and other data will automatically be computed and displayed. This Free Balloon Payment Calculator Excel Template makes it easy and quick for you to calculate your monthly payments and other financial data. This information will be helpful in helping you determine how much more payments you need to pay off your loan. This also helps you create a monthly household budget or personal budget.

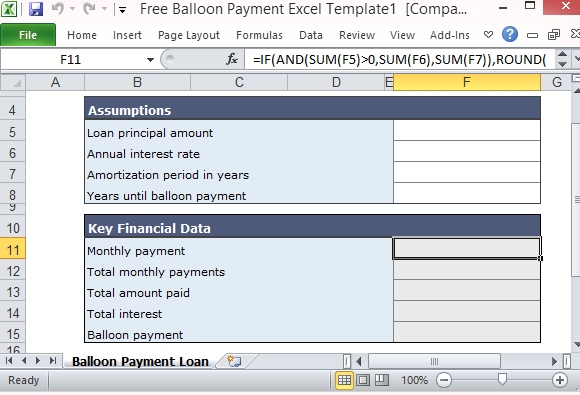

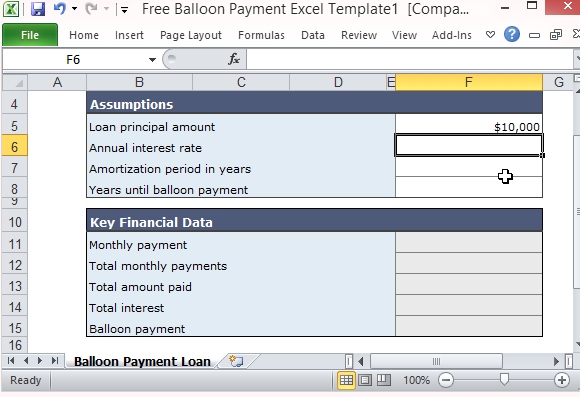

This Free Balloon Payment Calculator contains two parts: Assumptions and Key Financial Data. The Assumptions table is where you type in your data. It displays information like Loan Principal Amount, Annual Interest Rate, Amortization Period in Years, and Years Until Balloon Payment.

The second part of this calculator template is the Key Financial Data table. This part is automatically computed with the formula that already comes in with the template. It contains the Monthly Payment, Total Monthly Payments, Total Amount Paid, Total Interest, and Balloon Payment. These are the crucial details any debtor needs to be able to plan for payments and ensure that the debt or loan gets paid before the interest rate increases.

This template works with Excel 2003 and later versions, including Excel 2013.

Go to Download Free Balloon Payment Calculator Excel Template

Leave a Reply