Like businesses, households and families also have incomes and expenses. Similarly, families would also benefit greatly from having a monthly budget that they can work with in order for them to have a good cash flow. Establishing your monthly budget will let you know how much you can spend and allocate them to your most important items, such as groceries and utilities. This will help prevent you from overspending, while allowing you to set aside money for your savings.

Prevent Yourself from Going Over Your Budget

Microsoft Office contains a wide selection of budget templates not only for businesses but for families as well. One of these is the Monthly Family Budget Template for Excel, which is specially designed for personal use. This free template is especially designed to help families create realistic budgets for the various monthly expenses for their homes.

This Monthly Family Budget Template for Excel conveniently sets your monthly income and computes it against your monthly expenses. This will help you project your spendings and, over the course of the year, see how much you have spent and set aside for savings and if you have used your money wisely.

This Monthly Family Budget Template for Excel allows you to categorize your monthly expenses and keep a comprehensive record of your expenditures as well as your various sources of income. Your income may come from the head of your family and from other members, as well as other income sources such as salaries or business revenues.

Have Enough Money Left for Savings

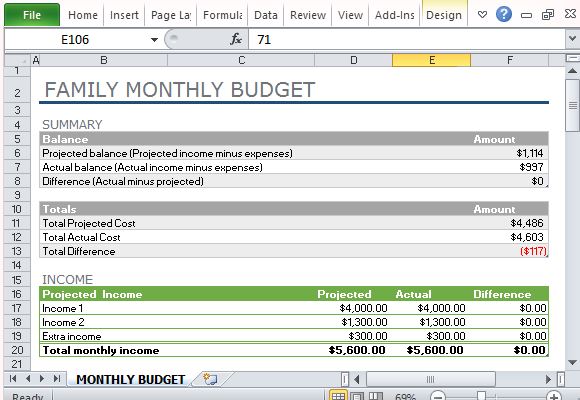

This Excel Template contains a Balance Summary that shows your Projected Balance, Actual Balance, and the Difference between the two. The Totals can also be seen in the template, which includes Total Projected, Actual and Total Cost, as well as the Total Difference. This way, you can see if you have spent within your monthly income with some money left to save.

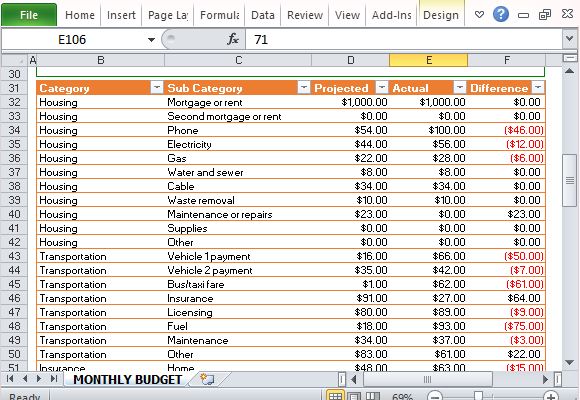

Within the same worksheet, you can see a separate table each for the income and expenditures so you can easily identify the money that comes in and out of your household. For income, you can list your various income sources. Meanwhile, in your Expenditures table, you can classify your spendings according to various categories.

All the categories and subcategories can be edited to suit the actual spending patterns of your family. As you customize the template, you don’t have to worry about manually calculating the results because the template comes built in with formula to accurately display totals, as well as allow you to easily filter your data.

Leave a Reply